Some Of Protecting Assets After Assessment

Wiki Article

How Currently Not Collectible Status can Save You Time, Stress, and Money.

Table of ContentsSome Ideas on Delinquent Federal Taxes You Should KnowInnocent Spouse Defense - QuestionsUnknown Facts About Irs Collections RepresentationSome Known Factual Statements About Federal Tax Preparation About Tax Audit Defense

Offering a reward and/or discount rate to clients who offer recommendations is a fantastic means to increase your company. Having a special offer for brand-new customers likewise aids. An additional fantastic method to raise business is to start networking. Venture out as well as around as well as end up being referred to as the "tax obligation expert". You can join a group like Company Network International (BNI).Click right here for even more details. R&M Consulting is a consulting company that operates in 2 key locations: tax obligation and also inner audit. To buy tax obligation outsourcing, R&M provides a complete, complete indirect tax solution that consists of protected data transfer, data conversion, hands-on computations, as well as precise income tax return and repayment processing.

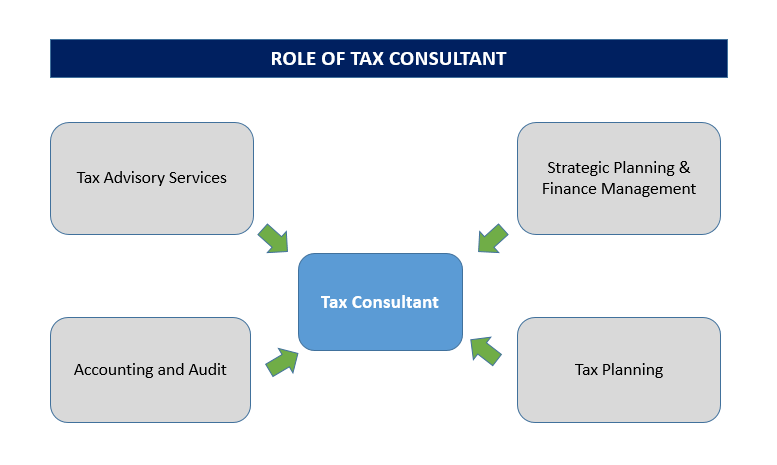

We have helped various global corporations navigate the difficult globe of tax obligation conformity, providing us the side to sustain you promptly, effectively, and also with confidence. RSM Jordan takes your corporate needs seriously as we build your custom-made tax solutions, assisting us create tax obligation planning methods that deliver. Some of the tax consultancy services we cover include: Tax preparation to avoid excessive tax expenses, utilizing possibilities within tax regulation Reporting any weak spots in your corporate tax method Preparing and sending your annual tax obligation returns Professional tax obligation guidance on appointments associated to basic tax issues Participating in investigation sessions usually held by the assessor and going over the outcomes and verdicts Regular reports on regulations changes that impact your organization Developing specialized tax obligation solutions and also techniques to reinforce your current tax design When your organization requires tax consultancy services, get in touch with our professionals - Tax Planning.

Not known Facts About Accounting / Bookkeeping

Tax prep work services mainly focus on preparing your tax obligation return (like this). Some might also offer tax preparation solutions to aid you decrease your tax obligations due in the current and also future tax obligation years.

After finishing your return, your preparer needs to sign the return as a paid preparer. They may additionally e-file your return for you. You may bring your tax documentation and rest with the preparer as they deal with your tax return. Other workplaces might allow you to hand over your documentation and prepare your return for you at a later date.

An Unbiased View of Federal Tax Preparation

The VITA program uses totally free tax obligation preparation help to those that certify. On the other end of the range, CPAs likely charge the most for their solutions, which can face the hundreds or countless dollars - Protecting Assets After Assessment. Some tax preparation solutions might allow you to pay for their charge out of your reimbursement, yet this technically ends up being a lending as well as has other costs consisted of.Just how Is a Tax Obligation Preparation Service Different From Tax Preparation Software Application? top article A tax obligation prep work solution prepares your tax obligation return on your part. They sign the tax return as a paid preparer. When you approve the return, they can even file the income tax return in your place. Tax preparation software application needs you to input the info, which is after that transferred to the income tax return types.